Tapping Your Untapped Engagement Advantage

It’s no secret that the member-payer relationship is transforming from purely transactional to one that is more supportive, wellness-focused, and consultative. There are solid business imperatives behind a health plan’s urgency for member engagement. Increasing member engagement has been a top priority for health plans for years. As managed care has become the predominant form of health care in most parts of the United States, payers are laser-focused on ways to simultaneously improve member health and trim costs. Plans will need members to be active participants in their health journey to accomplish these goals.

- Retaining your members is important and engaging them in your offerings helps build loyalty, making it less likely for members to leave.

- Driving your members to high-value, high-impact activities helps save you money and boosts return on investment. You already have to send member communications – why not make them impactful?

- Every instance of engagement reduces a member’s overall cost because over time, the member is staying healthier and utilizing their available resources.

The engaged member accesses care when they must, but also self-administers healthy activities throughout the year, reducing their personal cost.

The unengaged member waits until they are very ill, then places extra burden on the insurance company by seeking higher-cost care.

For health plans, the key to building engagement is to provide members with interactions that are just as timely, relevant, and convenient as those they experience in other areas of their lives. In other words, there is already a roadmap for successfully engaging with members, and payers are being incentivized to follow it as superior member experience is increasingly being rewarded.

Star Ratings, HEDIS scores, and CAHPS surveys all heavily weigh member experience when evaluating health plans:

- Starting in 2022, and informing the 2023 Star Ratings, patient experience is now quadruple rated. This means customer experience metrics will represent 57% of a plan’s overall STAR Rating.

- Half of the customer experience metrics are determined by CAHPS survey questions.

- The most important variables impacting customer experience are call hold times, call duration, rejected claims, number of claims, pharmacy claim count, claim copay amount, and pharmacy copay amount.

Plans are finding that even small improvements in member experience can nudge the plan’s ranking to a higher STAR Rating and that they should invest accordingly.

With so many reasons to boost member engagement, plans are exploring every option. The good news is they don’t have to go far. Health plans have a prime opportunity to engage members using existing member communication channels like ID cards, welcome letters, EOBs, ANOCs, 1095-Bs, invoices, and more.

By optimizing member materials to increase their value in the eyes of the member, the budget dollars health plans are already spending on correspondence can generate more engagement and a much higher return on investment.

FREE DOWNLOAD

Elevate Your Healthcare Communcation

Avoid common mistakes with our FREE guide:

"10 Communcation Mistakes to Avoid".

Optimize How?

Behavioral science techniques and engagement best practices from other consumer-centric industries can be applied to payers’ interactions with their members. In a recent webinar, Clarity Software Solutions, and guest speaker, Engagys, discussed how plans can adapt those techniques and practices to deliver the engaging correspondence members respond to.

Personalization Drives Action

We have all been shown product recommendations and targeted ads based on our search history or prior purchases. What we’re seeing is “know your audience” in action.

In member communications, that translates to understanding the different demographics and priorities of members in the commercial, Medicaid, and Medicare markets. Each audience has been proven to respond to relevant, clear, and concise messaging and easy-to-complete next steps that are aligned with their market.

For example, a commercial member is more likely to have a family with children compared to the other markets. Often budget conscious, they tend to respond more favorably to a cost savings message. Scarcity (“Only three spaces left!”) and exclusivity (“Available only to GROUP members”) are effective behavioral science tactics for messaging to commercial populations.

Plans should align their engagement goals with the themes that resonate most with members in that market. When simplicity, family, and convenience are the themes, as they are for commercial market members, plans should target engagement goals like portal registration, primary care physician utilization, and health risk assessment completion.

Following that same logic, plans targeting Medicare and dual market members should keep in mind that maintaining a fifth-grade reading level will increase message accessibility and that 70% of dual eligible individuals have three or more chronic conditions. With access and convenience in health care interactions being top priorities with this population, plans should focus engagement goals on telehealth utilization, primary care physician access, and mental wellbeing.

When plans use multi-channel communications to steer seniors in Medicare to in-network providers, engagement results almost double. Senior members in this population know what they know and are therefore less susceptible to peer pressure messaging like “80% of women your age use hormone replacement therapy.”

When used together, personalization plus behavioral principles drive increased engagement. But that’s just the first of the optimization techniques available to plans.

CONTACT US

Accelerate Member Engagement

Optimize member correspondence by driving increased engagement around high-priority initiatives to deliver measurable results.

Say It, Everywhere

When multi-channel communications all reinforce a consistent and unified message to the member, the effect is compounded and the opportunities to engage are multiplied. Therefore, the correspondence that members receive from their plan should be on the same page as every other form of communication about their health.

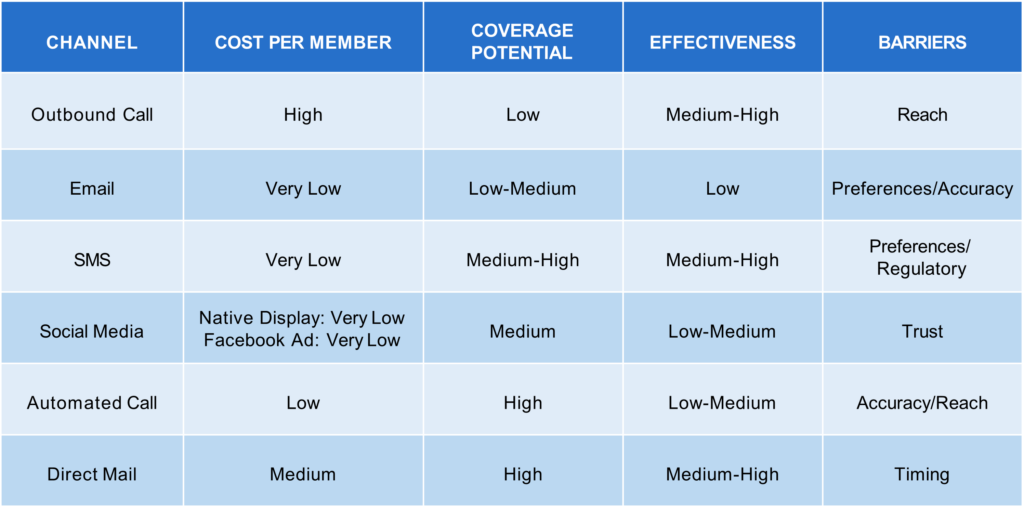

Knowing that multiple touches are necessary to drive action, plans need to utilize a mix of channels so that engagement is effective and efficient.

Journey > Destination

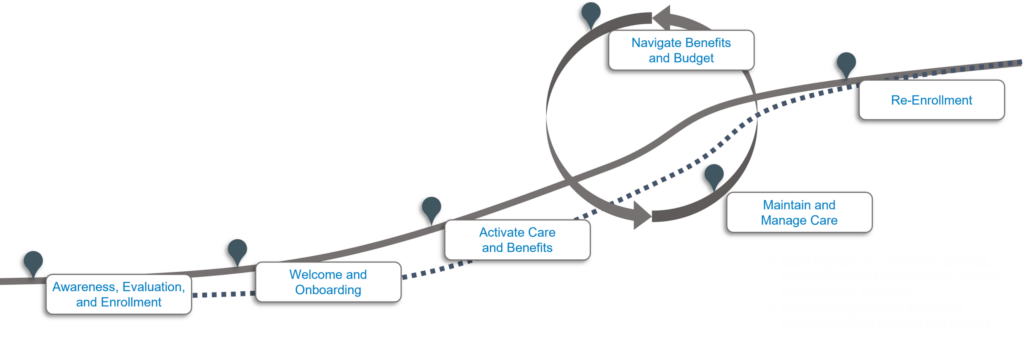

The intention is to align your communications with the personal member journey. Don’t just overwhelm members during onboarding. Instead utilize key trigger events, such as a claim denial or a life-altering diagnosis, as touchpoints throughout their membership. This way, you show members you understand them and consistently highlight value.

Your multi-channel communications should tie together and reflect recent events, when possible, to leverage opportunities to provide individualized content and support. Lean on simplicity, brevity, and personalization.

Be sure to provide a clear call to action that requires member interaction or response. Actionable segments will drive more engagement and behavior change and can be further improved upon with a test-and-learn approach.

For members, aligning communications across touchpoints and channels goes a long way toward enhancing customer experience and increasing loyalty, which in turn leads to better ratings and higher retention and ROI for health plans.

FREE DOWNLOAD

Secure Your Healthcare Payer Communications!

Stay compliant ad ahead of risks. Download our FREE guide on best practices & tips now.

Attention, Please!

Plans should rely on data to identify what to say and when. Predictive analytics can play a key role in identifying how to reach the right members, with the right message, at the right time to guide them toward their next best action, such as registering for the payer portal.

While most analytic solutions can tell you what happened and what is likely to happen next, what plans need for improved engagement is insight on what to do with what you’ve learned, or prescriptive analytics. By using claims data and consumer data, health plans can get better at targeting.

Once you have a handle on the right members, messaging, and timing, the last piece of the puzzle is member attention. That is where health plans have a distinct advantage: existing transactional mail.

With 97% open rates and members spending an average of two to five minutes with the communications they receive from plans, these millions of touchpoints are all highly underutilized opportunities to drive members to act and engage with their health plan. Other industries, like banking, finance, and retail, can only dream of having a channel with their customers that gets such dedicated attention.

It’s time for health payers to leverage that advantage.

Make the Leap, Forward

Of the multiple and competing pressures payers are facing, few are as mission critical as member engagement. For all the reasons we’ve covered, the bottom line for payers and the sustainability of the health insurance business model is dependent on the success of member engagement efforts.

Plans already have the vehicle for improved engagement in existing member communications. Take the leap to be able to answer questions like:

- Do QR codes work for pre-Medicare populations?

- Is text message the best way to engage millennials?

- How do subscriber-only memberships engage differently than subscribers with multiple dependents?

Your print communications should answer questions like these to ensure correspondence is central to organizational strategy. Now is the time to transform correspondence from a transactional, one-way communication into an iterative, data-driven test and learn process that constantly informs health plans of what engages every member best.